The Various Types of Quants and Quant Employers

The various types of quant roles and types of quant employers.

Quants Come in Different Shapes and Sizes

Students looking to enter the field of quantitative finance often have the misconception that there exists only a single type of quant. Often a quant is thought of as a statistical wizard creating algorithms and models to beat the financial markets. In reality, there are a multitude of different types of quants, each performing very distinct types of tasks. The great part about this is that it means that quantitative finance invites individuals from a variety of fields of study outside of pure finance. Whether it is writing code that makes you happy or building statistical models, there's a quant role that may be right for you.

In this article, we'll take a deep dive into the various types of quant roles that exist. In addition, we'll also look at the various types of different employers that look to hire quants. Overall, this article will give you a good understanding of the different career paths one could take within quantitative finance and what companies they could potentially end up working at.

Types of Quant Jobs and Roles

Front Office Quant

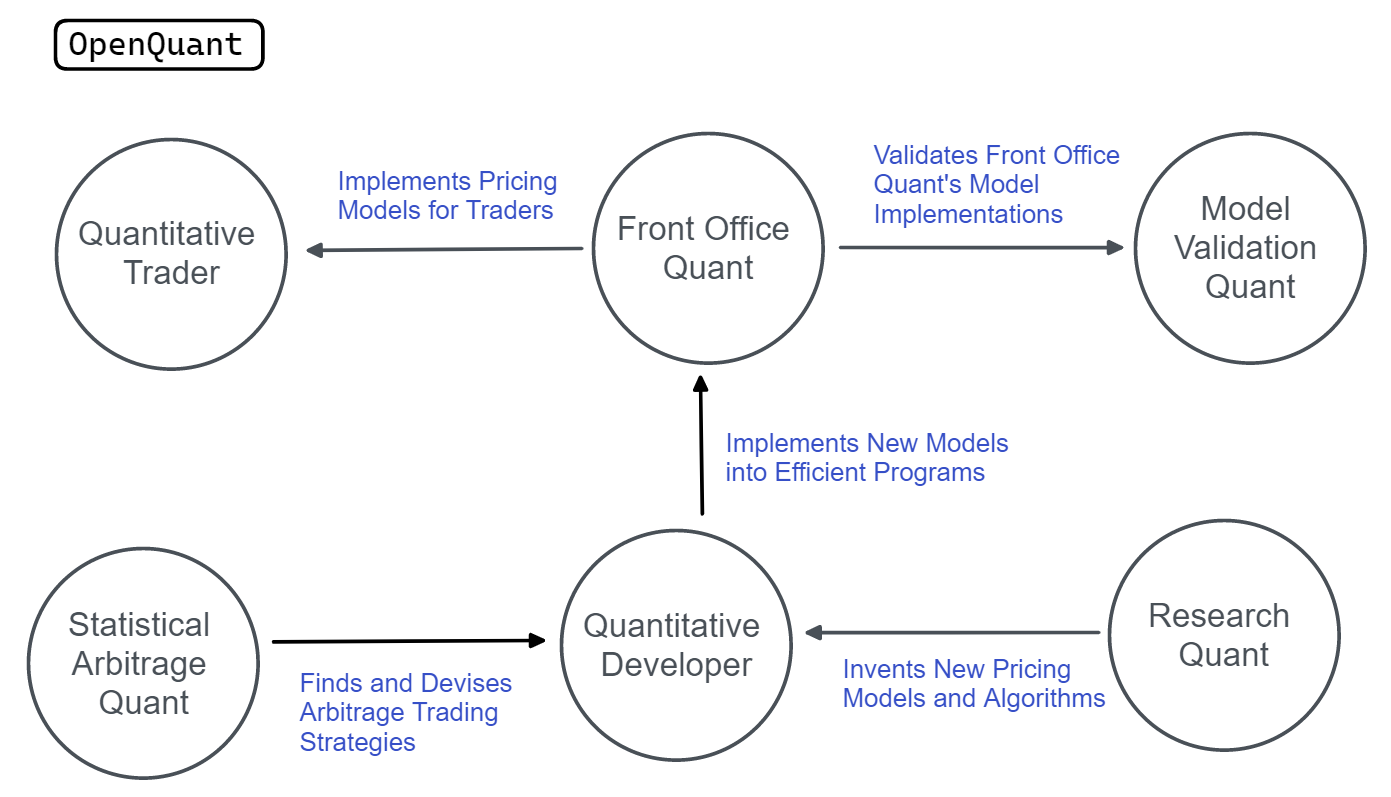

A front-office quant, often called a desk quant, typically works very closely with the traders that are executing the trades for the firm. Their work consists of implementing pricing models that traders can then leverage. Given the close tie between these quants and traders, many often end up transitioning to a trading role. This role tends to also be more stressful than the rest, given the speed at which these quants need to provide the models to the traders.

Model Validation Quant

A model validation quant takes the models that the front-office quant is using and validates their performance. While this role is crucial to ensuring that the traders in the firm are using accurate models, the work also tends to be uninspiring given that these quants aren't allowed to build and research new models of their own.

Research Quant

A research quant works on inventing new derivative pricing models and algorithms that can be leveraged by the firm to derive alpha. These quants tend to do the most mathematically rigorous work and therefore often come from Graduate school or some strong research background.

Quantitative Developer

A quantitative developer is often referred to as a "glorified software engineer". These quants have the strongest computer science background and are responsible for building/managing the firm's trading systems, writing ad-hoc scripts to automate tasks, and to help implement models developed by the quant researchers.

Statistical Arbitrage Quant

A statistical arbitrage quant works on finding anomalies and patterns in large volumes of data that can then be implemented into trading strategies. These types of quants are found primarily at data-driven hedge funds and also commonly go by the title "Data Scientist".

Capital Quant

A capital quant works on modeling a bank or firm's credit exposures and capital requirements. These quants are employed by large insurance companies, actuarial firms, and banks. The work of these quants is usually less technically demanding and more math-heavy.

Portfolio Manager

Portfolio managers are very important to a quant firm. They work on using various mathematical and statistical strategies to manage a firm's money and profitably allocate resources. Many large asset management companies employ portfolio managers.

Types of Quant Employers

Commercial Banks

Commercial banks tend to have teams of traders but they are often siloed and receive less pay than quants in other roles. Some examples include JP Morgan Chase and Bank of America.

Investment Banks

Investment banks hire quantitative strategists and researchers. Some good examples include Goldman Sachs and UBS.

Hedge Funds

Hedge funds hire quants to build derivative pricing models and algorithmic trading strategies for the firm. Some good examples include Two Sigma and Citadel.

Accountancy and Insurance Firms

Large accounting firms bring on quants for consulting purposes and major insurance companies hire them for capital management. Some good examples include Nationwide Insurance and PwC.

Exchanges

Financial exchanges often hire quants to conduct market research and analysis. Some good examples of exchanges that hire quants are the Nasdaq and Kalshi.

Conclusion

Thanks for reading this article, we hope that you found it helpful! If you're interested in finding jobs and internships in quantitative finance, check out OpenQuant, and we'll catch you next time!